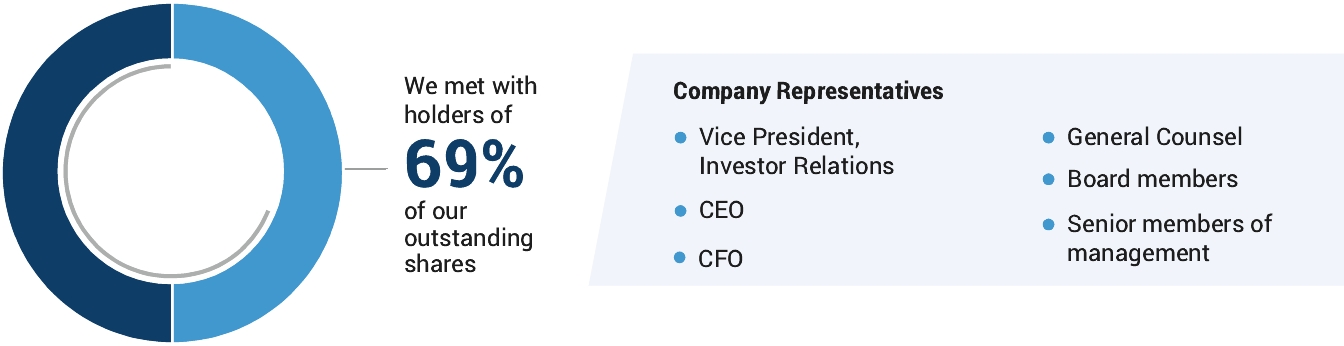

| • ongoing conflict between Russia and Ukraine and the resultant sanctions on Russia and Belarus;

• business strategy;

• financial performance;

• Company culture and ongoing integration and restructuring efforts;

| 26

| | |  l• executive compensation;

• financial impacts from lower carload volumes;

• status/impact of Erie strikes;

• acquisition contributions to 2023 financials;

• order pipeline and cadence of multi- year backlog;

• operating leverage in Freight and Transit segments;

• capital allocation; | | | • corporate governance practices;

• next generation technology (hydrogen/ battery locomotives);

• impact from regulations and potential emission changes in California;

• Board composition; and

• other topics, including climate-related risks and opportunities. |

| Following our Annual Meeting, our engagement efforts continue so that we may follow up on matters brought to our attention and/or discuss new issues of interest. We also respond routinely to individual stockholders and other stakeholders who inquire about our business. Input from our stockholders helps us formulate an appropriate action plan for addressing certain issues. |

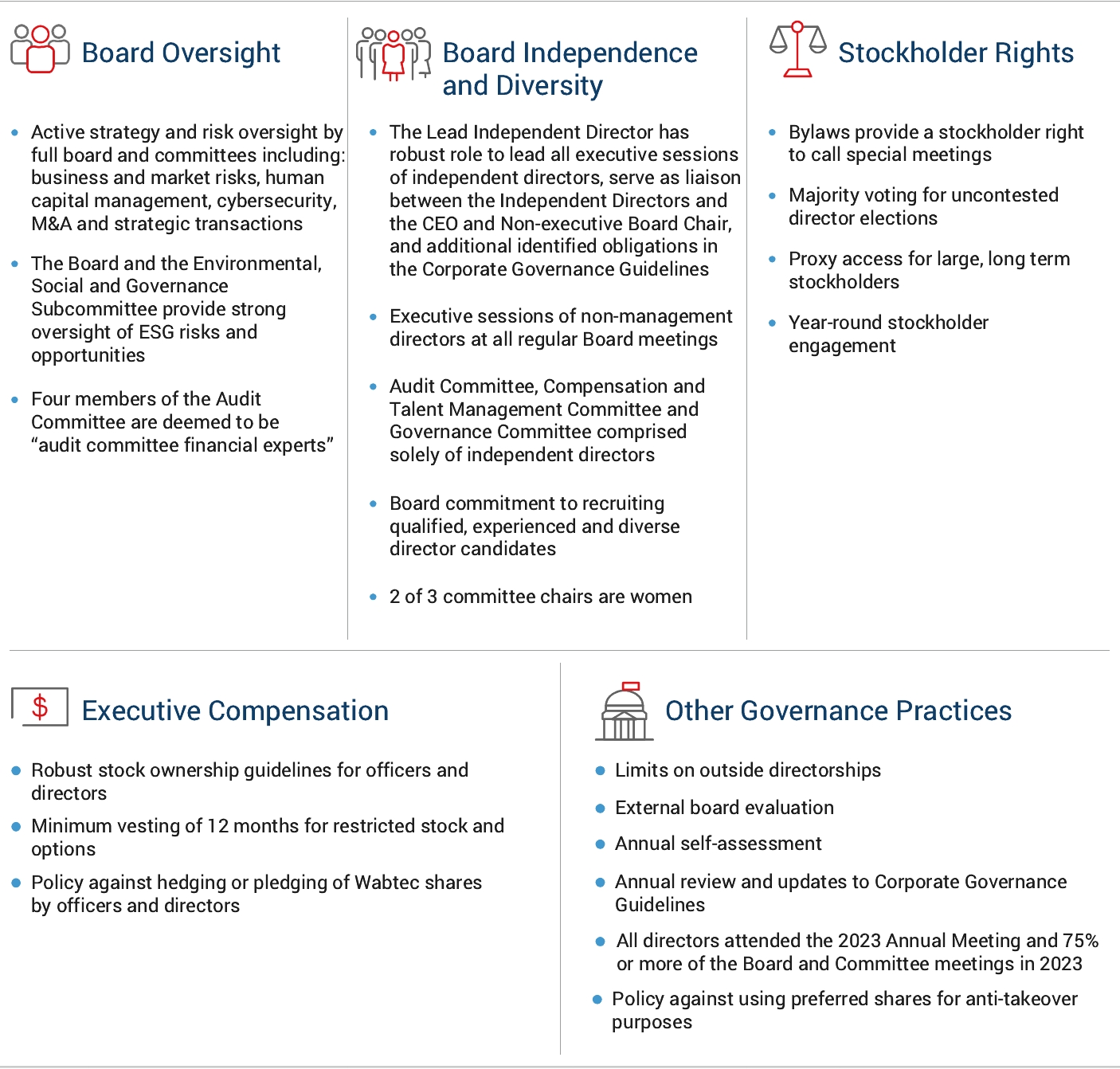

Communication with the Board The Board provides a process for interested parties to send communications to the Board or any of the directors of Wabtec. Communications to the Board or any director should be sent c/o the Secretary of Wabtec, 30 Isabella Street, Pittsburgh, PA 15212. All such communications except for spam, junk mail, mass mailings, solicitations, resumes, job inquiries, surveys or other matters unrelated to the Company, will be compiled by the Secretary of Wabtec and submitted to the Board or the individual director at the next regularly scheduled meeting of the Board. Interested parties may also communicate directly with the Lead Independent Director at the email address nonmanagementdirectors@wabtec.com. Governance Policies and Practices Corporate Governance Guidelines, Code of Conduct and Business Ethics and Compliance Program Charter Wabtec has adopted Corporate Governance Guidelines and a Code of Conduct and Business Ethics that are applicable to all directors, officers and employees, each of which includes the provisions required under applicable SEC and NYSE regulations. Copies of our Corporate Governance Guidelines and Code of Conduct and Business Ethics are posted on our website at http://www.wabteccorp.com -> investor relations -> corporate governance. 34 | | / | 2024 Proxy Statement for 2022 Annual Meeting |

TABLE OF CONTENTS Business Relationships and Related Party Transactions Pre-existing Relationships Pursuant to the terms of Wabtec’s amended and restated by-laws, William E. Kassling will be nominated to be a member of the Board so long as he is able and willing to serve and beneficially owns a certain percentage of Wabtec common stock. Related Party Transaction Approval Policy Our Board has adopted a written policy regarding related party transactions, a copy of which is available on Wabtec’s website at http://www.wabteccorp.com. Under this policy, the Governance Committee must review and approve in advance all related party transactions that are required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC. If advance approval is not feasible, the Governance Committee must approve or ratify the transaction at its next scheduled meeting. Transactions required to be disclosed pursuant to Item 404 include any transaction or series of similar transactions, arrangements or relationships in which Wabtec or any of its subsidiaries was, is, or will be a participant, the amount involved exceeds $120,000 and in which any of the following persons had, has or will have a direct or indirect material interest: any director, director nominee, or executive officer of Wabtec; any holder of more than five percent of Wabtec’s common stock; any Immediate Family Member (as defined in the policy) of any of the foregoing persons; and any entity which is controlled by someone listed above. In reviewing related party transactions, the Governance Committee evaluates all material facts about the transaction, including the nature of the transaction, the benefit provided to Wabtec, whether the transaction is on commercially reasonable terms that would have been available from an unrelated third-party and any other factors necessary to its determination that the transaction is fair to Wabtec. 2023 Related Party Transactions During 2023, Wabtec sourced approximately $23 million worth of goods from Dana Incorporated. One of our directors, Mr. Foster, currently serves as an executive officer of Dana Incorporated and his interest in this transaction is limited to such capacity. The Board’s Governance Committee has reviewed and approved this transaction. During 2023, Wabtec sourced approximately $32 million worth of goods from Parker-Hannifin Corporation. One of our directors, Mr. Banks served as an executive officer of Parker-Hannifin Corporation and his interest in this transaction is limited to such capacity. The Board’s Governance Committee has reviewed and approved this transaction. TABLE OF CONTENTS At Wabtec, we are committed to a strong environmental, social, and governance framework that ensures not only our own long-term success, but also leads our industry and stakeholders to a sustainable, cleaner, safer, and more inclusive transportation future. To that end, our sustainability priorities are embedded into our governance framework, stakeholder engagement, strategic decision making, and our evolving portfolio of products and services that we deliver for customers. This commitment starts at the top of the organization as both our Board of Directors and executive leadership team are actively engaged in Wabtec’s ESG strategy development and oversight. This commitment helps to shape Wabtec’s sustainability vision: Wabtec is committed to sustainable value creation. Our strategy is to contribute to a better, more sustainable world through our unique business offerings, leading technologies, and sustainable business practices. These help us capitalize on market opportunities and reduce safety and environmental risks, while creating value for our customers, employees, and other stakeholders. Oversight of Sustainability Our ESG governance framework starts with our Board of Directors, who oversee the execution of the Company’s ESG strategy within their oversight of Wabtec’s overall business, risks and opportunities. The Board, under the leadership of the Governance Committee and its ESG Subcommittee, oversees our sustainability strategy and execution against our ESG goals; reviews climate-related risks and opportunities; enhances enterprise risk strategy and management systems; addresses Environmental, Health, and Safety (EHS) matters; and shapes public policy and advocacy efforts. In 2023, Wabtec elevated our commitment by creating a new role — Chief Strategy and Sustainability Officer who manages the Company’s overall strategic sustainable efforts. 36 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Internally, the Wabtec Sustainability Task Force meets quarterly to advance the Company’s sustainability strategy. This team is comprised of leaders across all functions and business segments, including EHS, Operations, Engineering, Finance, Sourcing, Legal, and Human Resources. They are responsible for implementing actions within those functions that support Wabtec’s ESG framework and strategy. These processes complement, and are complemented by, our broader ERM process, which is our primary vehicle for assessing and managing operational, strategic, financial, and compliance risk. Guarding against ESG risks is a critical risk area evaluated as part of this process. Sustainability Highlights Wabtec continues to make progress delivering on its sustainability goals: Created new executive role, Chief Strategy and Sustainability Officer. Joined the United Nations Global Compact in 2022 demonstrating our existing and ongoing commitment to universal sustainability principles. Set new near-term absolute greenhouse gas (GHG) reduction goal to reduce our Scope 1 and 2 emissions by 50% by 2030, from a 2019 baseline. Disclosed Wabtec’s Scope 3 greenhouse gas emissions across our full value chain for the first time. Partnered with the rail industry to accelerate the development, validation, and adoption of lower carbon fuels and alternative clean energy technologies. Largely on-track to achieve Wabtec’s 2030 sustainability goals. TABLE OF CONTENTS Progress Drives Performance Wabtec is committed to continued progress on the sustainability areas we believe are critical to long-term success. The recent publication of our 2023 Sustainability Report reflects our efforts to enhance our sustainability reporting and transparency. Our reporting process not only helps us manage and measure our progress, but also helps us engage with internal and external stakeholders around the world.

More than 24,000 locomotives globally traveled over 1.8 billion miles and helped end customers eliminate over 138 million metric tons of GHG emissions by choosing rail over truck transportation. Approximately 336 million pounds of end-of-life material was sent back to global remanufacturing facilities, with 82% being reused or remanufactured and 18% recycled, leaving less than 1% waste. Reduced fine particulate matter emissions by up to 90% with our Transit Green Friction product deployed on metro train braking systems. Awarded Norfolk Southern’s inaugural Thoroughbred Sustainability Partner Award, recognizing partner companies who are leaders in the categories of energy efficiency, innovation, and environmental stewardship. 35% reduction in Scope 1 and 2 GHG emissions compared to 2019 baseline, on track toward our 2030 goal of 50% reduction. 18% reduction in water consumption compared to 2019 baseline. 20% reduction in the total recordable injury and illness rate compared to 2019 baseline.

Significant year-over-year progress on all diversity, equity, and inclusion targets. 11% increase in female representation globally. 2023 Best Place to work for Disability Inclusion: Disability Equality Index 38 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Elements of Director Compensation

Each director is paid a cash retainer of $125,000 and an annual stock retainer of $180,000. In addition, each director serving in certain positions receives additional cash retainers as detailed below. $200,000 | | | $35,000 | | | $25,000 | | | $25,000 | | | $20,000 |

2023 Director Compensation The following table provides information concerning the compensation of our non-employee directors for the period January 1, 2023 through December 31, 2023: Albert J. Neupaver, Chair | | | $325,000 | | | $180,013 | | | $505,013 | Beverley A. Babcock | | | $125,000 | | | $180,013 | | | $305,013 | Lee C. Banks | | | $125,000 | | | $180,013 | | | $305,013 | Byron S. Foster | | | $125,000 | | | $180,013 | | | $305,013 | Linda A. Harty | | | $180,000 | | | $180,013 | | | $360,013 | William E. Kassling | | | $125,000 | | | $180,013 | | | $305,013 | Brian P. Hehir | | | $150,000 | | | $180,013 | | | $330,013 | Ann R. Klee | | | $150,000 | | | $180,013 | | | $330,013 |

1

| Reflects the aggregate grant date fair value dollar amount calculated in accordance with ASC 718 related to the awards of stock to the non-employee directors under the 1995 Non-Employee Directors’ Fee and Stock Option Plan. |

2

| The annual award of the $180,013 stock retainer was made on May 16, 2023, with each non-employee director being granted 1,857 restricted shares of Wabtec common stock with a grant date fair market value of $96.94 per share. Such restricted shares generally vest 12 months from the date of grant. If a director voluntarily resigns or is otherwise terminated within 12 months from the grant date of the restricted shares, the director will forfeit the restricted shares. See “Common Stock Ownership” for a description of outstanding awards held by the non-employee directors. |

TABLE OF CONTENTS All directors are reimbursed for their out of pocket expenses incurred in connection with attendance at meetings and other activities related to the Board or its Committees. The Company offers a Deferred Compensation Plan for non-employee directors. Under the terms of the plan, eligible directors may defer the annual stock and/or cash retainer, provided that any deferral of the stock retainer will be subject to the same vesting and forfeiture conditions as if the stock retainer had not been deferred. Deferred amounts, including any applicable earnings credited on the deferrals, will be paid out to the director following his termination of service with the Board. Ms. Babcock has deferred 1550 shares. The Compensation Committee reviews director compensation on an annual basis. At the May Compensation Committee meeting, the Board’s external compensation consultant provides the Compensation Committee with a market analysis detailing: i) cash retainers, ii) equity compensation, and iii) Board leadership retainers. The market analysis provides market data, trends and findings from both peer group and general industry data. Upon review and discussion of the data, the Compensation Committee recommends and the Board approves the compensation cash retainer, Board leadership retainers, and equity compensation for the upcoming year. Director Compensation Policies and Practices Stock Ownership Guidelines

Wabtec has established stock ownership guidelines to encourage Board members to own and retain shares of stock.

Non-employee Board members are required to accumulate shares having a value equal to six times their cash retainer.

Directors are given five years to satisfy these guidelines. Shares that count toward the holding requirement include any shares owned by the director in Wabtec’s share administration platform, the deferred compensation plan, personal accounts, or any unvested restricted shares. All directors except for Mr. Foster and Ms. Babcock have met the ownership guidelines. Mr. Foster and Ms. Babcock are within the 5-year compliance period and are on-track to meet the compliance requirement. 40 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Proposal

2 | Proposal 2—Advisory (Non-Binding) Resolution Relating to the Approval of 2021Vote To Approve Compensation Of Our Named

Executive Officer CompensationOfficers | |

As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd- Frank Act”), we are providing our stockholders with the opportunity to cast a non-binding vote to approve our executive compensation programs and arrangements in accordance with Section 14A of the Exchange Act. In 2017,2023, our shareholdersstockholders indicated their approval of the Board of Directors’ recommendation that we solicit an advisory vote such as this on an annual basis. Our Board of Directors has adopted a policy that is consistent with that preference and, accordingly, we are providing our stockholders with an opportunity to vote on this proposal at this Annual Meeting. A “say on-frequency” vote is required every six years, and as such, our next say-on-frequency vote is expected to occur in 2023. As described in greater detail under the heading “Compensation Discussion and Analysis,” on page 2943 we seek to closely align the interests of our named executive officers with the interests of our stockholders. Our compensation programs are designed to reward our named executive officers for the achievement of short-term and long-term strategic and operational goals and the achievement of increased total stockholder return, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. The overall objectives of our executive compensation program are to (i) enable us to attract, motivate and retain key executive talent essential to the achievement of our short-term and long-term business objectives; (ii) provide compensation competitive with others in our industry; (iii) reward senior executive officers in a “pay for performance” manner for accomplishment of pre-defined business goals and objectives; and (iv) align the interests of our executives with those of our stockholders. A significant portion of total executive compensation is variable compensation linked to corporate, business unit and individual performance. Our objective is to provide a significant portion of an executive’s total compensation in a form that is contingent upon achieving established performance goals that are intended to align the executives’ interests with those of our stockholders. In regard to compensation based on long-term performance, our objective is to provide a significant portion of such compensation in the form of equity awards. Pursuant to the SEC rules, we are asking you to approve the 2021 compensation of the named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K of the SEC, including the Compensation Discussion and Analysis, the compensation tables and other narrative executive compensation disclosures.

Under the Dodd-Frank Act and the related SEC rules, your vote on this resolution is an advisory or “non-binding” vote. This means that the purpose of the vote is to provide stockholders with a method to give their opinion to the Board of Directors of Wabtecthe Company about certain issues, like executive compensation. None of the Board, its committeesCommittees or Wabtecthe Company is required by law to take any action in response to the stockholder vote. However, the Board values our stockholders’ opinions, and the Board intends to evaluate the results of this year’s vote carefully when making future decisions regarding compensation of the named executive officers. The stockholder advisory vote in connection with our 20212023 annual meeting received over 90%approximately 93% approval by our stockholders, indicating support of our compensation programs and policies. We believe that providing our stockholders with the opportunity to cast an advisory vote on our executive compensation program on an annual basis will further enhance communication with our stockholders, and it meets our obligations under the Dodd-Frank Act and the SEC’s rules. We are required to seek a stockholder vote on the frequency of the advisory vote to approve our executive compensation programs and arrangements (the “SOP Frequency Vote”) every six years. As noted above, in 2023, we conducted a SOP Frequency Vote, and our stockholders indicated their approval of the Board’s recommendation that we solicit an advisory vote to approve named executive officer compensation on an annual basis. The next SOP Frequency Vote is expected to be held at our 2029 annual meeting of stockholders.  l Proxy Statement for 2022 Annual Meeting | | | 27

| |

TABLE OF CONTENTS

Vote Required This proposal is adopted if a majority of the shares present in person or by proxy vote for the proposal. Because the total shares voted “for,” “against,” or “abstain” are counted to determine the minimum votes required for approval, if you abstain from voting, it has the same legal effect as if you vote against. If a broker limits the number of shares voted on the proposal on its proxy card or indicates that the shares represented by the proxy card are not being voted on the proposal, it is considered a broker non-vote. Broker non-votes are not counted as a vote or used to determine the favorable votes required to approve the proposal. TABLE OF CONTENTS Proposal 2: Advisory Vote To Approve Compensation Of Our Named Executive Officers

The Board recommends that you approve the following resolution: RESOLVED, that the stockholders approve the 20212023 compensation of the named executive officers, as disclosed in this proxy statementProxy Statement pursuant to Item 402 of Regulation S-K of the SEC, including the Compensation Discussion and Analysis, the compensation tables and other narrative executive compensation disclosures. | ✔ | | | The Board recommends you vote FOR the approval of the 20212023 compensation of our named executive officers, as disclosed in this proxy statementProxy Statement pursuant to Regulation S-K of the SEC. | |

42 | 28

| | / |  l 2024 Proxy Statement for 2022 Annual Meeting |

TABLE OF CONTENTS Compensation Discussion and Analysis | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As of December 31, 2021, our named executive officers (“NEOs”) were:

Our named executive officers (“NEOs”) for 2023 are: | Name

| | | Title

| | | Rafael Santana

| | | | | | | | | | Rafael Santana

President and Chief Executive Officer | | | | John Olin

| | | Executive Vice President and Chief Financial Officer | | | | David L. DeNinno

Executive Vice

President, General

Counsel and Secretary | | | Executive Vice President, General Counsel and Secretary

| | | Pascal Schweitzer

President, Transit(1) | | | President, Freight Services Group

| | | Eric Gebhardt

| | | Executive Vice President and Chief Technology Officer |

(1)

| Pascal Schweitzer was named President, Transit in April 2023. Previously, Mr. Schweitzer served as President, Freight Services from February 2019 to April 2023. |

2024 Proxy Statement | Patrick Dugan /

| | | Former Executive Vice President and Chief Financial Officer43

| |

In connection with the termination of his employment, Mr. Dugan ceased being Executive Vice President

TABLE OF CONTENTS Compensation Discussion and Chief Financial Officer effective October 1, 2021. Mr. Olin became the Company’s Executive Vice President and Chief Financial Officer effective October 1, 2021. See “2021 Severance of Mr. Dugan” on page 50.Analysis

This Compensation Discussion and Analysis should be read in conjunction with the tabular and narrative disclosures beginning on page 2961 of this Proxy Statement. See “Executive Compensation“Compensation Philosophy and Objectives” on page 3246 and the tables that follow for more information regarding our executive compensation programs. Continued Impact of Covid-19 Pandemic

In 2023, the Company reviewed and set executive base salaries, modified its annual cash incentive plan design and issued equity under the Company’s long-term incentive plan.

2023 Performance Highlights In 2020, Wabtec implemented changes to our compensation programs2023, the Company delivered strong financial performance as a result of the Covid-19 pandemic (“COVID”). These included preliminarily freezing salaries for all salaried employees, subsequently paying meritevidenced by higher year-over-year increases in a lump sum,revenues, operating margin expansion and modifying the metrics and weightings associated with our Annual Cash Incentive Program. As Wabtec re-evaluated our compensation programs in 2021, the Company made the decision to re-implement the annual merit increase process for all employees, modified our Annual Cash Incentive Plan back to similar design and metrics utilized prior to the pandemic and made adjustments to our 2019 - 2021 long term incentive plan. The modifications included the following:

Annual Cash Incentive Plan

The weighting associated with the individual performance goals was reinstated, with individual performance being weighted at 20%;

Metrics were changed back to earnings per share growth. The Company had strong execution in a volatile environment with increased sales driven by strong Freight and earnings before interest and taxes;

Transit growth. The Company had strong cash flow from operations metric was not changed; Financial metrics were weighted at 80%; and

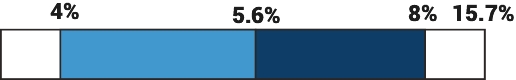

generation enabling investment for future growth while maximizing shareholder returns. | $9.68B | | | 13.1%

GAAP | | | $4.53

GAAP

| | | $1.2B

Operating cash flow driven by higher net income tempered by higher working capital to support strong sales growth across the portfolio | Up 15.7%

Year over Year

Increased sales were driven by strong growth across the Freight and Transit segments | | | 17.0%

Adjusted(1)

| | | $5.92

Adjusted(1)

GAAP EPS up 30.9% Year over Year

Adjusted EPS up 21.8% Year over Year from higher Freight and Transit sales | | | |

(1)

| Please refer to the Appendix to this Proxy Statement for a description and reconciliation of these non-GAAP financial measures relative to reported GAAP financial measures. |

44 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Compensation Discussion and Analysis

2023 Compensation Highlights Elements of Compensation The metrics were weighted as follows:

| | EPS - Corporate | | | 48.0% | | | 19.5% | | | | Cash from Operations - Corporate | | | 32.0% | | | 12.5% | | | | EBIT - Group | | | | | | 28.5% | | | | Cash from Operations - Group | | | | | | 19.5% | | | | Corporate (Total) | | | 80% | | | 80% | | | | Personal Performance | | | 20.0% | | | 20.0% | | | | Total | | | 100.0% | | | 100.0% | |

EPS means our “adjusted earnings per diluted share” as described in our 2021 year-end earnings release included with our Form 8-K filed on February 16, 2022. The amount is based on our GAAP earnings per diluted share, adjusted for amortization expense, certain restructuring costs and other non-recurring items detailed in the earnings release.

Cash from operations means our “adjusted cash flow” based on our GAAP cash flow from operations, adjusted for certain restructuring costs and other non-recurring items detailed in our earnings release included with our Form 8-K filed on February 16, 2022.

EBIT means our “adjusted earnings before interest and taxes” (as described in our 2021 year-end earnings release included with our Form 8-K filed on February 16, 2022). The amount is based on our GAAP income from operations, adjusted for amortization expense, certain restructuring costs and other non-recurring items detailed in the earnings release.

The modifications to our Annual Cash Incentive Plan are discussed in more detail below in the “Components of Compensation” beginning on page 35.For 2021, bonuses were earned under the plan at 144.81% of target for Mr. Santana, Mr. Olin, Mr. DeNinno, Mr. Gebhardt, and Mr. Dugan. Mr. Schweitzer’s bonus was earned at 137.52% of target.

2019 – 2021 Long-Term Incentive Program

In its deliberations, due to the impact of COVID on the business, the Compensation Committee also determined that modifications were necessary to the 2019 – 2021 long-term incentive program. Rather than having one three-year performance period, the Compensation Committee decided to split the performance periods into three separate periods: one for 2019, one for 2020 and one for 2021. The performance measurement of economic profit did not change. Performance for each period is measured separately, and the payout is determined by averaging the payout percentages of the three separate performance periods. The economic profit goal was achieved at target for 2019, but not achieved for 2020 or 2021. Therefore, payouts for the 2019 - 2021 performance period were earned at 33% of target on three-year economic profit goals established in February 2019. The modifications to our 2019 – 2021 long-term incentive program are discussed in more detail below in the “Components of Compensation” beginning on page 35. | 30

| | |  l Proxy Statement for 2022 Weighting | | | 2023 Performance Metrics | Base Salary | | | | | | • Individual contribution to business results

• Tenure

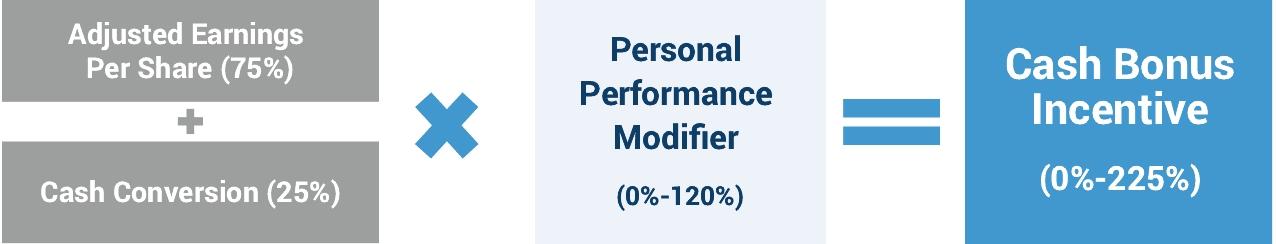

• Capabilities and qualifications | Annual MeetingCash Incentive | | | | | | • Earnings per share (75%)

• Cash conversion (25%)

• Personal performance modifier (0%-120%)

| Long-Term Equity Incentives | | |

| | | • 60% performance units and 40% time-vesting restricted stock

For performance units:

* 3-year average annual return on invested capital (50%)

• 3-year average annual cash conversion (50%)

• Subject to relative total stockholder return (RTSR) modifier (+/- 20%) |

The Compensation Committee reviewed the results of the 2023 stockholder advisory vote on executive officer compensation and incorporated the results as one of the many factors considered in connection with the discharge of its responsibilities. At our 2023 annual meeting of Stockholders, approximately 93% of the votes cast approved the compensation program described in the Company’s 2023 proxy statement. The Compensation Committee interpreted this level of support as affirmation of the design and objectives of our executive compensation programs and therefore did not make any significant changes to such programs as a direct result of such vote. The Compensation Committee continues to monitor best practices among the Company’s peer group and industry standards related to executive compensation programs. | | | |

TABLE OF CONTENTS Compensation Discussion and Analysis

|

Compensation Governance Best Practices The Compensation Committee has implemented the following best practices with respect to the executive compensation program: ✔ Review the executive compensation programs each year and the Company’s long-term business strategy, the results of the most recent say-on-pay advisory vote and contemporary market practices as periodically provided by our independent consultant.

✔ Use the Company’s stock price and other value-creating financial metrics such as earnings before interest and taxes (EBIT) margin, earnings per share working capital,(EPS), cash flow,conversion, return on invested capital (ROIC) and relative total stockholder (RTSR) return in our executive incentive programs.

✔ Annually review the risks associated with our compensation programs and mitigate the risks by:

• capping incentive payouts earned under our annual cash incentive award plan and ourcapping the number of performance units earned under the long-term performance unit long-term incentive plan;

• maintaining stock ownership guidelines for executive management and non-employee directors;

directors;

• maintaining a recoupmentclawback policy that applies to our our cash and equity incentive awards;

• maintaining a policy that prohibits the pledging of of Company stock; and

• maintaining a policy that prohibits the hedging of of Company stock.

✔ Require both a qualified change in control and involuntary or “good reason” employment termination (double trigger) for any cash severance to be paid under our change in control agreements. | | | ✘ Gross-up for income or excise taxes on perquisites or severance benefits related to a change in control.

✘ Provide executives with an enhanced executive retirement program but rather provide a defined contribution or defined benefit plan similar to that provided to all employees in the country where such employees reside.

reside.

✘ Provide dividends or dividend equivalents on unearned performance shares.

✘ Re-price or backdate stock options. |

2021 Business Highlights

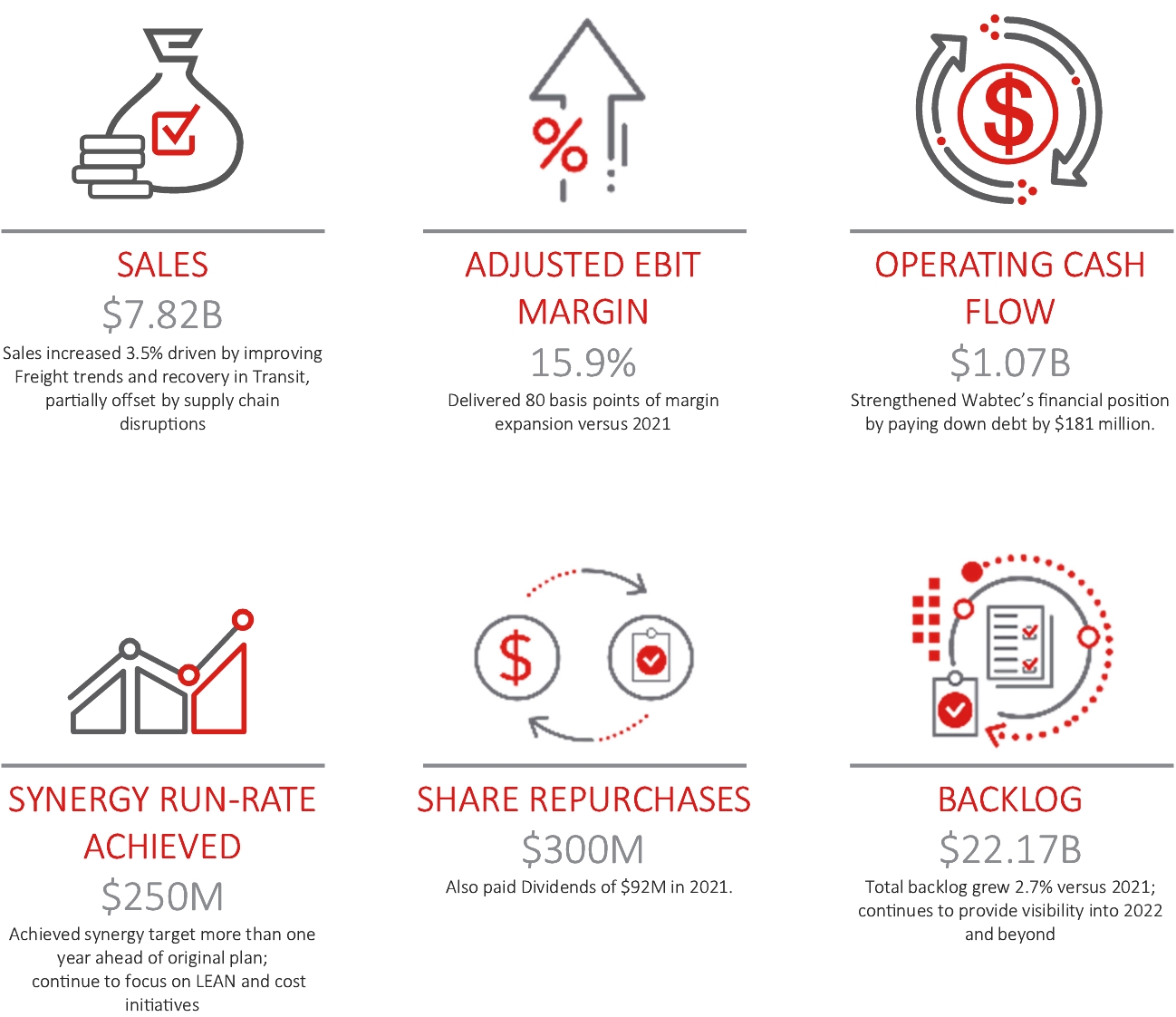

In 2021, Wabtec delivered strong financial performance driven by growth in both Freight and Transit segments. Sales increased 3.5 percent to $7.82 billion and cash flow from operations was a record $1.07 billion. We achieved an adjusted EBIT margin of 15.9 percent and ended the year with adjusted earnings per diluted share of $4.26, excluding certain expenses detailed later in this report.

We aggressively mitigated the impacts of escalating metals, labor and logistics costs; components shortages; and supply chain disruptions. Additionally, we accelerated integration synergies, achieving $250 million of run-rate synergies in the third quarter of 2021, more than one year earlier than forecasted. These actions continue to position the Company for long-term profitable growth.

Our balance sheet was strengthened by reducing debt by $181 million, while keeping a focus on our liquidity position, which at end of year stood at $1.67 billion in cash, cash equivalents, and available credit facilities. We executed on our strategic priorities and returned $392 million of capital to shareholders via dividends and share repurchases. Our multi-year backlog also remained strong at $22.17 billion, giving us good visibility into 2022 and beyond.

l Proxy Statement for 2022 Annual Meeting | | | 31

| |

TABLE OF CONTENTS

Key business highlights include:

*

| See page 57 for reconciliation of GAAP to non-GAAP measures referenced in this section. |

Role of 2021 Advisory Vote on Executive Compensation in the Compensation Decision Process

The Compensation Committee reviewed the results of the 2021 stockholder advisory vote on executive officer compensation and incorporated the results as one of the many factors considered in connection with the discharge of its responsibilities. At our 2021 Annual Meeting of Stockholders, over 90% of the votes cast approved the compensation program described in our 2021 proxy statement. The Compensation Committee interpreted this level of support as affirmation of the design and objectives of our executive compensation programs; however, the Compensation Committee continues to monitor best practices and the practices of our peers to improve our compensation program.

Executive Compensation Philosophy and Objectives Overview.This compensation discussionCompensation Discussion and Analysis describes the material elements of compensation awarded to, earned by, or paid to each of our executive officers who served as named executive officers during 2021.2023. This discussion focuses primarily on the fiscal year 20212023 information contained in the following tables and related footnotes and narrative. We discuss compensation actions taken prior to 2021 or in 2022 if we believe it provides relevant information.

| 32

| | |  l Proxy Statement for 2022 Annual Meeting |

TABLE OF CONTENTS

The principal elements of our executive compensation program are base salary, annual cash incentives, and long-term equity incentives in the form of restricted stock awards and units, stock options and performance units. Our other benefits and perquisites consist of life and health insurance benefits, social and health club dues, and a qualified 401(k) savings plan (including company matching contributions). Our philosophy is to position the aggregate of these elements at approximately the median of that paid to executives of our Peer Group with similar responsibilities. To ensure that the Company is able to attract and retain highly talented and diverse executives, the Company benchmarks executive compensation using a reputable compensation survey of similar-sized companies and also uses available proxy disclosure compensation information of a group of similar-sized manufacturing companies. This group was reviewed and updated in late 2020. This peer group provided insights to the Compensation Committee as it made compensation decisions in 2021.

Our Peer Group represents a group of manufacturing companies who generally align with the following criteria:

Large industrial companies in Global Industry Classification Standard (“GICS”) sectors generally representing Machinery, Electrical Equipment, Auto Components, Aerospace and Defense and Road and Rail;

Revenues that range from approximately half to double that of the Company;

Market capitalization reasonably aligned with the Company; and

Capital intensive businesses.

This peer group was used for relative performance purposes for the Company’s 2021 long-term incentive plan and for use in making 2021 compensation decisions:

| AGCO Corporation

| | | Fortive Corporation

| | | Parker Hannifin Corporation

| | | AMETEK, Inc.

| | | Howmet Aerospace, Inc.

| | | Rockwell Automation, Inc.

| | | BorgWarner, Inc.

| | | Illinois Tool Works, Inc.

| | | Terex Corporation

| | | CSX Corporation

| | | Ingersoll Rand, Inc.

| | | Textron, Inc.

| | | Cummins, Inc.

| | | Navistar International Corporation

| | | The Greenbrier Companies, Inc.

| | | Dover Corporation

| | | Norfolk Southern Corporation

| | | Trinity Industries, Inc.

| | | Emerson Electric Co.

| | | Oshkosh Corporation

| | | Xylem, Inc.

| |

During fourth quarter of 2021, the Compensation Committee, with the assistance of its independent consultant, reviewed the peer group list. Twenty (20) of the 21 companies remained unchanged. The Compensation Committee removed Navistar as it was acquired in July 2021.

Objectives and Philosophy. The overall objectives of our executive compensation program are to (i) enable us to attract, motivate and retain key executive talent essential to the achievement of our short-term and long-term business objectives; (ii) provide compensation competitive with others in our industry; (iii) reward senior executive officers in a “pay for performance” manner for accomplishment of pre-defined business goals and objectives; and (iv) align the interests of our executives with those of our stockholders. A significant portion of total executive compensation is variable compensation linked to corporate, business unit and individual performance. Our objective is to provide a significant portion of an executive’s total compensation in a form that is contingent upon achieving established performance goals. In regardWith respect to compensation based on performance, our objective is to provide a significant portion of such compensation in the form of equity awards.

l Proxy Statement for 2022 Annual Meeting | | | 33

| |

TABLE OF CONTENTS

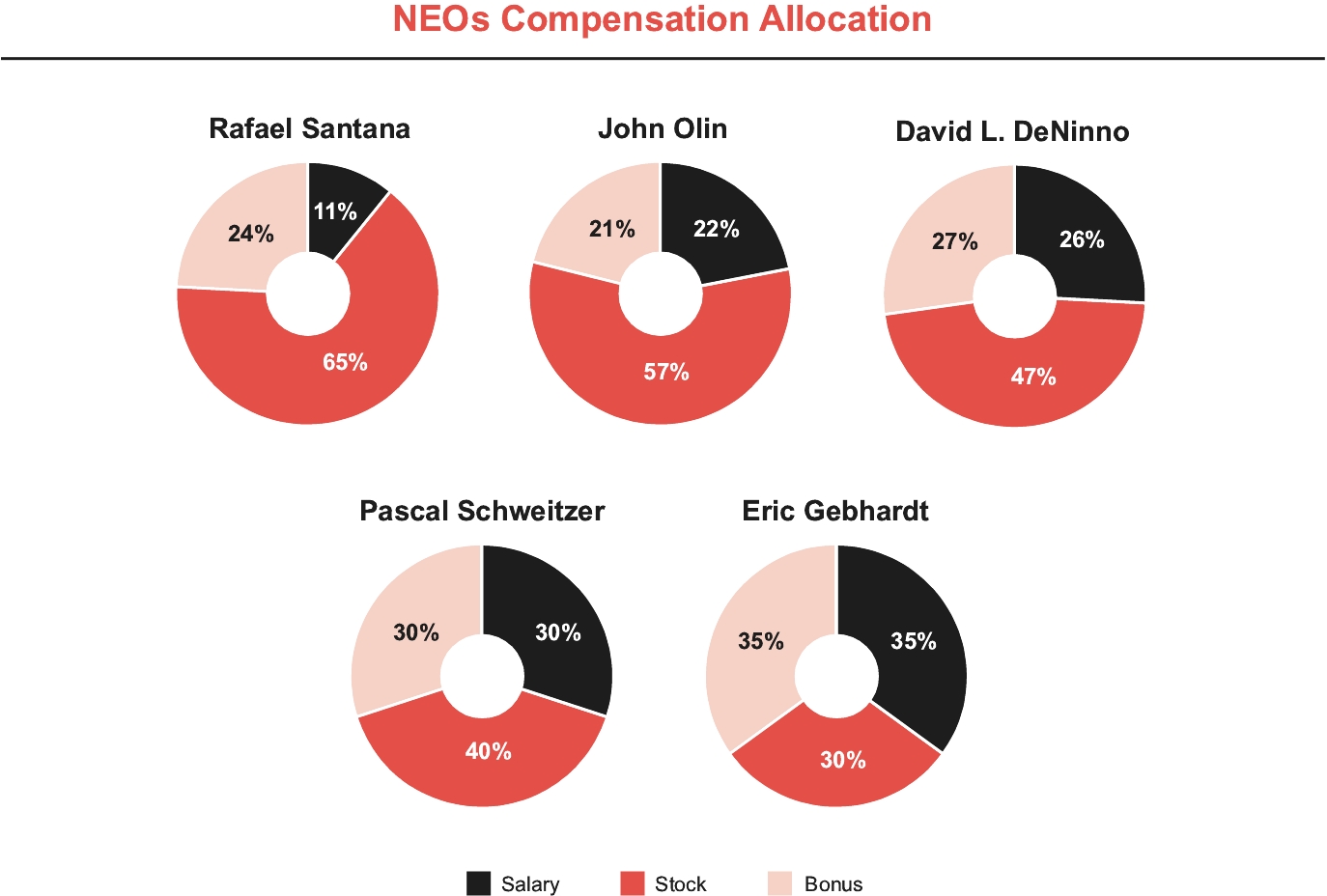

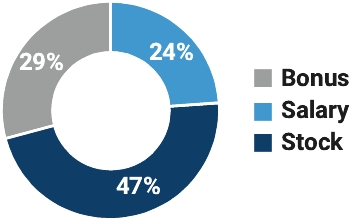

In 2021, our named executive officers’ compensation, based on actual amounts awarded, was allocated as follows (excluding Mr. Dugan because he was terminated during the year):

In setting base salaries at the beginning of the year, the Compensation Committee generally reviews benchmark information about compensation levels in Wabtec’s industry and among its peer group based on the position and responsibility of the particular executive provided by the Compensation Committee’s independent consultant. The Compensation Committee 46 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Compensation Discussion and Analysis

uses benchmarking to establish base salaries as discussed below. The cash bonus for 20212023 is a cash award determined by the Compensation Committee and Board based on pre-established performance factors. These factors are established at the beginning of the year and include (i) a financial performance indicator measuring EPS EBIT, and cash from operations;conversion; and (ii) a modifier for personal performance indicator which measures whether the individual executive attained certain quantitativeobjectives based on EBIT Margin and measurable objectives which are tied to the overall company strategic objectives for that year.revenue growth (each, as defined below). Long-term incentives in the form of stock options, restricted stock restricted stock units and performance units are granted to provide the opportunity for long-term compensation based upon the performance of Wabtec and its ability to meet its long-term goals and objectives. Executive Compensation Process.Decision-Making Process Compensation Committee. Executive officer compensation is administered by the Compensation Committee. The Compensation Committee approved the 2021 compensation programs for executive officers, including base salaries, cash bonusesRoles and equity awards, described in this compensation discussion and analysis and recommended them to the full Board, which then approved them. Our Board of Directors delegates to the Compensation Committee the direct responsibility for, among other matters:Responsibilitiesreviewing and approving goals and objectives for the Chief Executive Officer and determining the Chief Executive Officer’s compensation;

reviewing and recommending compensation of all non-employee directors and executive officers; and

reviewing and recommending incentive compensation plans and equity-based plans.

| 34Compensation Committee

| | |  lExecutive officer compensation is administered by the Compensation Committee. The Compensation Committee approved the 2023 compensation programs for executive officers, including base salaries, cash bonuses and equity awards described in this Compensation Discussion and Analysis and recommended them to the full Board, which then approved them. Our Board of Directors delegates to the Compensation Committee the direct responsibility for, among other matters:

• reviewing and approving goals and objectives for the Chief Executive Officer and recommending the Chief Executive Officer’s compensation to the Board for approval;

• reviewing and recommending compensation of all non-employee directors and executive officers; and

• reviewing and recommending incentive compensation plans and equity-based plans.

| Role of Compensation Experts | | | Pursuant to its charter, the Compensation Committee is authorized to engage compensation consultants to assist it with its duties. The Compensation Committee has the sole authority to engage any outside counsel or other experts or consultants to assist it in the evaluation of compensation of our directors and executive officers, including the sole authority to approve such consultants’ fees and other retention terms. The Compensation Committee may also obtain advice from legal, accounting, human resources and other advisors as it deems necessary. The Compensation Committee engaged the consulting firm of Pay Governance through August 2023 and Exequity for the remainder of 2023. During their engagements, Pay Governance or Exequity provided the following services: (i) reviewed and assessed the Company’s current compensation practices for executives; (ii) reviewed the current Peer Group and made recommendations to update the Peer Group; (iii) reviewed and provided a pay for performance assessment of the Chief Executive Officer compensation; (iv) provided plan design and performance metric benchmarking of the Peer Group and relevant industry data; (v) provided data and recommendations on changes to the annual cash incentive program; and (vi) provided data and recommendations associated with the long term incentive program. In 2023, Pay Governance reviewed and assessed the competitiveness of compensation provided to non-employee members of the Company’s Board of Directors. This review included benchmarking of the Peer Group and relevant industry data. The Committee has evaluated its relationship with each of Pay Governance and Exequity and has determined that no conflict of interest exists with respect to the services that either consultant provides. | Role of Our Executive Officers in the Compensation Process | | | The Chief Executive Officer and the Executive Vice President, Chief Human Resources Officer suggest guidelines in discussions with the Compensation Committee regarding executive compensation. They provide recommendations and information regarding the competitiveness of the industry, key employees, performance of individuals, succession plans and other relevant data to the Compensation Committee. Neither the Chief Executive Officer nor the Executive Vice President, Chief Human Resources Officer is present during any discussions concerning his or her own compensation. |

2024 Proxy Statement for 2022 Annual Meeting | / | | 47 |

TABLE OF CONTENTS Compensation Discussion and Analysis

|

Our philosophy is to position target total compensation opportunity within a reasonable range of Compensation Experts. Pursuantthe median of that paid to its charter,executives of our Peer Group with similar responsibilities. To ensure that the Company is able to attract and retain highly talented and diverse executives, the Company benchmarks executive compensation using a reputable compensation survey of similar-sized companies and also uses available proxy disclosure compensation information for a group of similar-sized manufacturing companies. This Peer Group provided insights to the Compensation Committee is authorizedas it made compensation decisions for 2023. Our Peer Group represents a group of manufacturing companies who generally align with the following criteria: large industrial companies in Global Industry Classification Standard (“GICS”) sectors generally representing machinery, electrical equipment, auto components, aerospace and defense, and road and rail; revenues that range from approximately 0.4 to engage2.5 times that of the Company; market capitalization of 0.25 to 4.0 times the Company; and capital intensive businesses. This Peer Group was used in making 2023 compensation consultantsdecisions: AGCO Corporation | | | Illinois Tool Works Inc. | | | Terex Corporation | AMETEK, Inc. | | | Ingersoll Rand, Inc. | | | Textron, Inc. | BorgWarner Inc. | | | Norfolk Southern Corporation | | | The Timken Company | CSX Corporation | | | Oshkosh Corporation | | | The TransDigm Group | Dover Corporation | | | Parker Hannifin Corporation | | | Xylem, Inc. | Eaton Corporation | | | Rockwell Automation, Inc. | | | | Emerson Electric Co. | | | Stanley Black & Decker, Inc. | | | |

Note that for the 2023-2025 performance units that were granted to assist itthe NEOs as part of the 2023 long-term incentive compensation awards, the Company utilized the XLI index and not its peer group (for previous cycles) for purposes of the relative total stockholder return portion of that award. See the Long-term Incentive Compensation section below for additional detail. Wabtec Peer Comparison The table below summarizes key scoping factors for the Company in relation to companies comprising the Peer Group. At the time the Compensation Committee reviewed comparative pay data in early December 2022, median trailing twelve month (“TTM”) revenues as of November 30, 2022 for this array of companies was $11.9 billion and median market capitalization as of November 30, 2022 was $21.9 billion, as compared to TTM revenues and market capitalization for Wabtec of $8.1 billion and $18.4 billion, respectively. Wabtec | | | $8,129 | | | $8,362 | | | $9,677 | | | $18,385 | | | $18,152 | | | $22,735 | Wabtec Percentile Rank | | | 42% | | | 41% | | | 44% | | | 37% | | | 38% | | | 40% | Peer Group 75th Percentile | | | $14,177 | | | $14,329 | | | $14,911 | | | $47,512 | | | $47,088 | | | $55,791 | Peer Group Median | | | $11,908 | | | $12,635 | | | $12,156 | | | $21,854 | | | $21,157 | | | $31,307 | Peer Group 25th Percentile | | | $5,870 | | | $6,033 | | | $7,120 | | | $11,022 | | | $10,730 | | | $12,066 |

48 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Compensation Discussion and Analysis

During the fourth quarter of 2023, the Compensation Committee, with the assistance of its duties.independent consultant, reviewed and amended the Peer Group. The Compensation Committee has the sole authority to engage any outside counsel or other experts or consultants to assist it in the evaluation of compensation of our directorsremoved BorgWarner, Inc. and executive officers, including the sole authority to approve such consultants’ fees and other retention terms.Terex Corporation. The Compensation Committee may also obtain adviceadded Jacobs Solutions, Inc. and Snap-on Incorporated. Changes to the Peer Group were made to better align with the criteria above and were primarily driven by industry alignment and financial comparability considerations. Compensation data from legal, accounting, human resources and other advisors as it deems necessary. The Compensation Committee engaged the consulting firm Pay Governance during 2021. During its engagement, Pay Governance provided the following services: (i) reviewed and assessed the Company’s current compensation practices for executives; (ii) reviewed the currentthis revised peer group and made recommendations to updatewill be considered for the peer group; (iii) reviewed and provided a pay for performance assessmentpurpose of the Chief Executive Officer compensation; (iv) provided benchmarking of peer group and relevant industry data; (v) provided data and recommendations associated with a review of the long term incentive program; and (vi) provided data and recommendations on changes to the annual cash incentive program. Role of Our Executive Officers in the Compensation Process. The Chief Executive Officer and the Executive Vice President, Chief Human Resources Officer suggest guidelines in discussions with the Compensation Committee regardingsetting 2024 target total executive compensation. They provide recommendations and information regarding the competitiveness of the industry, key employees, performance of individuals, succession and other relevant data to the Compensation Committee. The Chief Executive Officer is not present during any discussions concerning his own compensation.compensation opportunities.

Components of Compensation.2023 NEO CompensationOur 20212023 compensation program elements were primarily structured to reward our executive officers for achieving certain financial and business objectives. Wabtec’s philosophy is to position the aggregate of the compensation elements within a reasonable range of the median of that paid to executives in Wabtec’s peer group with similar responsibilities assuming target performance. Actual compensation earned will vary above or below target based on performance. The principal elements of our executive compensation program are base salary, annual cash incentives, and long-term equity incentives in the form of awards of restricted stock and performance units. Stock options were granted in prior years, but are no longer part of the long-term incentive design. Our other benefits and perquisites consist of life and health insurance benefits, social and health club dues, and a qualified 401(k) savings plan (including company matching contributions). Base salaries for our executive officers are reviewed annually and reflect the executive’s role and responsibility relative to the competitive market. In defining the competitive market, the Company uses two different benchmarks, compensation information representing our Peer Group and broader benchmark compensation data based on a survey of companies that are similarly sized in terms of revenue. Individual salaries may be above or below the competitive median based on the individual’s contribution to business results, length of time in role, capabilities and qualifications, potential and the importance of the individual’s position to our success. Due to the impacts of COVID, named executive officer base salaries were adjusted in December 2020 to reflect the base salary rates originally approved at the beginning of 2020 before the pandemic. None of Wabtec’s named executive officers were granted base salary increases in 2021. The Compensation Committee is dedicated to ensuring competitive compensation for each of Wabtec’s key employees and believes that current base salaries are in line with comparable industry practices. The base salaries and merit increases of our named executive officers for 2023 were as follows: Rafael Santana

President and Chief Executive Officer | | | $1,242,308 | | | $1,325,000 | | | 6% | John Olin

Executive Vice President and Chief Financial Officer | | | $750,000 | | | $765,000 | | | 2% | David L. Deninno

Executive Vice President, General Counsel and Secretary | | | $637,692 | | | $650,000 | | | 2% | Pascal Schweitzer

President, Transit | | | $537,692 | | | $614,5252 | | | 14% | Eric Gebhardt

Executive Vice President and Chief Technology Officer | | | $612,692 | | | $625,000 | | | 2% |

(1)

| Base salaries are reviewed annually for all of Wabtec’s named executive officers. Increases to base salary are awarded at the beginning of the pay period following review in February by the Compensation Committee. Base salary increases are awarded upon analysis of market data and the executive’s individual performance. Any increases are effective as of February 20, 2023. |

(2)

| Mr. Schweitzer started 2023 in the United States on a U.S. salary. In February 2023 his U.S. salary was increased to $550,000 annually. In April 2023 Mr. Schweitzer returned to Europe on a Swiss-based compensation package. His base salary was changed to 525,250 CHF. The 2023 salary for Mr. Schweitzer includes the combined salary in both locations. For Mr. Schweitzer, all compensation amounts paid in CHF were converted to U.S. dollars using the exchange rate in effect as of the last day of the fiscal year. |

TABLE OF CONTENTS Compensation Discussion and Analysis

Annual Cash Incentive Awards.CompensationOur annual incentive award plan is intended to: (i) compensate participants directly ifbased on the extent to which personal, strategic and financial performance targets are achieved and (ii) reward participants for performance on those activities that are most directly under their control and for which they are held accountable. Corporate, business unit and individual performance goals under the annual incentive plan are linked to our annual business plan and budget. The actual amount of cash bonuses is a function of the Company’s overall financial performance, the participant’s individual performance and Board approval.  l Proxy Statement for 2022 Annual Meeting | | | 35

| |

TABLE OF CONTENTS

The cash bonus targets for 2021table below shows the target amount for each of the named executive officersNEOs’ 2023 annual bonus opportunity expressed as a percentage of base salary were:(which percentages for each NEO remained the same as 2022) salary:  For 2021, Mr. DeNinno’s bonus target was increased from 70% of his base salary to 80% of his base salary to more closely align with market practice and his contributions to the business.

Overall, total target cash compensation (the sum of salary and target cash bonus) for our executive officers is intended to be competitive with market practice for similar executive positions in similar companies when performance goals under the annual cash bonus plan are achieved. Entering 2021,Cash bonuses are earned based on financial and personal performance in accordance with the following formula:

50 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Compensation Discussion and Analysis

For 2023, the Company re-evaluated the changes it had made toadjusted the cash bonus incentive program as a resultby changing the weightings of the impact of COVIDmetrics and the components which comprise the personal performance modifier. In addition, the Compensation Committee determined that Mr. Santana and the entire executive team continued to be measured on the business in 2020. After careful evaluation and review, design of the 2021 cash incentive program was reverted back to a plan design similar to what the Company had adopted at the beginning of 2020. 2021 cashsame goals. Cash bonuses arefor 2023 were based upon the following success of two factors: Financial Performance | EPS | | | 75% | | | Adjusted earnings per diluted share calculated as U.S. GAAP earnings per diluted share, adjusted for non-cash amortization expense and certain restructuring costs | | | | Cash Conversion | | | 25% | | | Cash conversion means (A) the Company’s cash from operations divided by (B) the sum of the Company’s net income plus depreciation and amortization adjusted for certain restructuring costs | | | | Personal Modifier | Personal Performance Modifier | | | 0%-120% modifier | | | The personal performance modifier serves as a multiplier to the financial performance constituting 80%results. The modifier may be based on individual goals such as goals related to EBIT, acquisitions, or other individual goals for the executive and can be achieved anywhere between 0% and 120% of the total payout opportunity, measured by adjusted earnings per share (“EPS”),financial performance result. The two goals used in the personal performance modifier for 2023 are EBIT Margin and revenue growth, each weighed equally.

EBIT Margin means our “adjusted earnings before interest and taxes (“EBIT”) and cashtaxes” calculated as our U.S. GAAP income from operations, (measured excluding extraordinary items relatedadjusted for non-cash amortization expense and certain restructuring costs, divided by consolidated revenue.

Revenue growth means the percentage increase in the Company’s gross revenues from fiscal year 2022 to transaction costs, restructuring, and debt refinancing costs); and |

(2)

2023. | personal performance constituting 20% of the total payout opportunity, measured by whether the executive attains certain goals agreed to by the executive, the executive’s supervisor, and the Board. | | |

The weighted average results of the two measurements are then combined and called the combined performance factor or “CPF”. The cash bonus formula is based on the product of the participant’s base salary, the participant’s target cash bonus percentage, financial performance and the CPF.personal modifier. If both the financial performance and the applicable personal performance results are achieved, the named executive officersNEOs will earn 100% of their target cash bonus. Each financial metric includes a threshold level of performance, (generally,generally, 80% of the target goal at which a minimum 25% payout will be made),made. Performance below whichthe threshold level would result in no payout will be made on the financial metric. Each financial metric also includes a maximum level of performance, (generally,generally 125% of the target goal),goal, at which a maximum 225% payout will be made on that financial metric. To calculate the payout percentages, the goal achievement percentage is first determined. Once the goal achievement percentage is determined, the actual payout percentage is calculated using linear interpolation. There are two payout lines: One for goal achievement between 80% and 100%, resulting in a payout between 25% and 100% and a second for goal achievement between 100% and 125%, resulting in a payout between 100% and 225%. The outcome of the financial metrics is then multiplied by the personal performance modifier. The personal modifier has a range 80% to 120%. The maximum payment under the plan including the personal performance modifier is 225%. We believe that this philosophy encourages Wabtec and our executives to establish ambitious goals and that the program promotes teamwork, productivity and profitability. Target cash bonuses and performance factors were approved by the Compensation Committee at its meeting in February 2021.2023.

| 36

| | |  l2024 Proxy Statement for 2022 Annual Meeting | / | | 51 |

TABLE OF CONTENTS Compensation Discussion and Analysis

|

The table below provides both the 20212023 financial metricsperformance goals and our performance achieved in 2021with respect to adjusted EPS and Cash Conversion (adjusted for certain restructuring costs) for our corporate wide executives including Mr. Santana, Mr. Olin, Mr. DeNinno, and Mr. Gebhardt: | | Earnings Per Share | | | Financial | | | $3.28 | | | $4.10 | | | $5.13 | | | $4.26 | | | 48.00% | | | 56.78% | | | | Cash From Operations | | | Financial | | | $726

Million | | | $907

Million | | | $1.13

Billion | | | $1.119

Billion | | | 32.00% | | | 69.40% | | | | EBIT Margin % | | | Personal | | | 12.1% | | | 15.1% | | | 18.9% | | | 15.9% | | | 10.00% | | | 12.65% | | | | Acquisition Goal

| | | Personal | | | $280 M

| | | $350 M

| | | $437.5 M

| | | $312.5 M

| | | 10.00% | | | 5.98% | | | | | | | | | | | | | | | | | | | | | | Total | | | 144.81% | |

Mr. Schweitzer’s compensation included certain performance metricseach of the Freight Services Group. The metrics were established by the Compensation Committee. The table below provides the Corporate, Freight Services and individual metrics for Mr. Schweitzer.NEOs:

Financial | EPS(1) | | | | | | $5.92 | | | 158.49% | | | 118.87% | Cash Conversion | | |

| | | 91% | | | 107.41% | | | 26.85% | Total Financial | | | | | | | | | | | | 145.72% | Discretionary

Adjustment(2) | | | | | | | | | | | | | | | | | | (4.0%) | Overall Financial Result | | | | | | | | | | | | | | | | | | 141.72% | Personal | EBIT Margin(1) % | | | | | | 17% | | | 112.0% | | | 56.00% | Revenue Growth | | | | | | 15.7% | | | 120.0% | | | 60.00% | Individual Multiplier | | | | | | | | | | | | 116.00% | | | | | | | | | | Total | | | 164.40% |

1

| This is a non-GAAP financial measure. See page A-1 for a reconciliation to the most directly comparable financial measure calculated under GAAP. The actual 2023 bonus awards as a result of this performance for the NEOs are shown under the “Non-equity Incentive Plan Compensation” column of the Summary Compensation Table on page 61. |

2

| This discretionary adjustment was determined by the Compensation Committee based on its review of various market factors and Company-wide incentive compensation decisions. |

52 | | / | 2024 Proxy Statement |

| | Earnings Per Share | | | Financial | | | $3.28 | | | $4.10 | | | $5.13 | | | $4.26 | | | 19.50% | | | 23.06% | | | | Cash From Operations -

Corporate | | | Financial | | | $726

Million | | | $907

Million | | | $1.13

Billion | | | $1.119

Billion | | | 12.50% | | | 27.11% | | | | EBIT - Services | | | Financial | | | $719

Million | | | $899

Million | | | $1.124

Billion | | | $979

Million | | | 28.50% | | | 41.17% | | | | Cash from Operations -

Services | | | Financial | | | $653

Million | | | $816

Million | | | $1.020

Billion | | | $850

Million | | | 19.50% | | | 23.47% | | | | EBIT Margin % -

Services | | | Personal | | | 30.7% | | | 38.4% | | | 48.0% | | | 39.2% | | | 10.00% | | | 10.21% | | | | Tier 4 FL/Y <2.5

| | | Personal | | | <2.7 | | | 2.5 | | | <2.0 | | | <2.1 | | | 10.00% | | | 12.50% | | | | | | | | | | | | | | | | | | | | | | Total | | | 137.52% | |

EPS means our “adjusted earnings per diluted share” as described in our 2021 year-end earnings release included with our Form 8-K filed on February 16, 2021. The amount is based on our GAAP earnings per diluted share, adjusted for amortization expense, certain restructuring costs and other non-recurring items detailed in the earnings release.

Cash from operations means our “adjusted cash flow” based on our GAAP cash flow from operations, adjusted for certain restructuring costs and other non-recurring items detailed in our earnings release included with our Form 8-K filed on February 16, 2022.

EBIT means our “adjusted earnings before interest and taxes” (as described in our 2021 year-end earnings release included with our Form 8-K filed on February 16, 2022. The amount is based on our GAAP income from operations, adjusted for amortization expense, certain restructuring costs and other non-recurring items detailed in the earnings release).

EBIT Margin means our “adjusted earnings before interest and taxes” (as described in our 2021 year-end earnings release included with our Form 8-K filed on February 16, 2022, with the amount being based on our GAAP income from operations, adjusted for amortization expense, certain restructuring costs and other non-recurring items detailed in the earnings release) divided by consolidated revenue.

Acquisition Goal represents the summation of the average of the purchase price and annualized revenue for each acquisition completed in 2021.

Tier 4 FL/Y <2.5 is the weighted average calculating the number of times a Tier 4 locomotive is out of service or encounters an unscheduled maintenance service in a calendar year. <2.5 calculates to a locomotive failing less than 2.5 times a year. For this purpose, a Tier 4 locomotive is a locomotive that meets the Environmental Protection Agency (EPA) emission level standard.

TABLE OF CONTENTS Compensation Discussion and Analysis

Rafael Santana

President and Chief Executive Officer | | | 160% | | | $2,120,000 | | | 141.72% | | | $3,004,464 | | | 116.0% | | | $3,485,178 | John Olin

Executive Vice President and Chief Financial Officer | | | 100% | | | $765,000 | | | 141.72% | | | $1,084,158 | | | 116.0% | | | $1,257,623 | David L. Deninno

Executive Vice President, General Counsel and Secretary | | | 80% | | | $520,000 | | | 141.72% | | | $736,944 | | | 116.0% | | | $854,855 | Pascal Schweitzer

President, Transit | | | 100% | | | $623,9811 | | | 141.72% | | | $884,306 | | | 116.0% | | | $1,025,795 | Eric Gebhardt

Executive Vice President and Chief Technology Officer | | | 100% | | | $625,000 | | | 141.72% | | | $885,750 | | | 116.0% | | | $1,027,470 |

1

| Represents Mr. Schweitzer’s base salary as of 12/31/2023 converted to USD |

Long-Term Incentive Compensation.CompensationOur Compensation Committee administers our long-term incentive compensation throughunder our 2011 Stock Incentive Plan, underpursuant to which we grant stock options, restricted stock restricted stock units and performance units. Our long-term incentive compensation program seeks to align the interests of our executives with those of our stockholders. We have typically granted stock options and restricted stockour executives long term equity awards in February or March of the applicable year.year, which for 2023 consisted of performance units weighted 60% and restricted stock weighted 40%. We did not grant options in 2023, (similar to 2022), but in prior years we have  l Proxy Statement for 2022 Annual Meeting | | | 37

| |

TABLE OF CONTENTS

awarded options to purchase our common stock to executive officers at the fair market value (average of the high and low price) of our common stock at the grant date. We have not re-priced or back-dated any option awards. The vesting schedulegrant size of each NEO’s long-term incentive awards is based on the Compensation Committee’s judgment and assessment of various factors, including individual performance, the individual’s responsibilities and position with our Company, market practice and values for eachsimilar roles within our peer group and other general industries. The Compensation Committee’s external compensation consultant provides both management and the Compensation Committee a market analysis on an annual basis. The analysis is then reviewed by the CEO and Chief Human Resources Officer who subsequently recommend long-term incentive award grant of optionsvalues to the Compensation Committee. Awards are then reviewed and restricted stock is determinedultimately approved by the Compensation Committee. In recent years,Neither the Compensation Committee has provided thatCEO nor the Chief Human Resources Officer make recommendations to their own pay. Equity awards made in 2023 to the NEOs are detailed under the table “2023 Grants of Plan Based Awards” on page 62. For 2023, Wabtec changed the methodology used to calculate the number of restricted shares and target number of performance units. Previously, the Company divided the target value of the awards generally will vest in annual equal installments over three years. Inby our closing average price on the grant date, but for 2023, to avoid the impact of single-day stock price volatility, the Company divided the target value by the 30-day trailing average share price as of the date of grant. The following provides additional information about those awards.Restricted Stock (40%) On March 2021,2, 2023, we granted both restricted stock and stock options to all named executive officersNEOs as part of their long-term compensation with the Company, (except for Mr. Olin who joined the Companywhich vests in October 2021).equal installments over three years. The grant date fair value of those awards is reflected in the Summary Compensation Table on page 4261. The CompanyPerformance Units (60%)

On March 2, 2023, we also administers a rolling three-year long-term incentive program usinggranted performance units.units to all NEOs. A performance unit is equal to a share of Wabtec common stock. This program is designed to reward executives for meeting or exceeding pre-established, objective financial performance goals over a three-year performance period. The program is structured as a rolling three-year plan; each year starts a new three-year performance cycle with the most recently commenced cycle being 2022-2024. For awards made for the 2019-2021 performance period, the awards are earned based on economic profit growth goals. Economic profit is a measure of the extent to which the Company produces financial results in excess of its cost of capital. Payouts range from 25% of target (for performance at 50% of target) to 200% of target (for performance at or above 150% of target). Specific Economic Profit Goals for the 2019 to 2021 plan were as follows:

| | 2019 | | | $121,698 | | | $243,397 | | | $365,095 | | | | 2020 | | | $50,128 | | | $100,257 | | | $150,385 | | | | 2021 | | | $76,701 | | | $153,402 | | | $230,103 | | | | Total | | | $248,527 | | | $497,056 | | | $745,583 | |

While the award was originally intended to measure Economic Profit over a cumulative three-year period, the Compensation Committee decided in 2021 to split the performance periods into three one-year periods (2019, 2020 and 2021) and then take the average payout percentage of the three single periods. This approach allowed the Compensation Committee to recognize strong performance in 2019 prior to COVID, which included the efforts of new participants in the plan who formerly worked for GE Transportation, without having to adjust the target performance goals. Based on this approach the actual payout was 33.0%.

| | 2019 | | | $121,698 | | | $243,397 | | | $365,095 | | | $243,497 | | | 100% | | | | 2020 | | | $50,128 | | | $100,257 | | | $150,385 | | | ($72,510) | | | 0% | | | | 2021 | | | $76,701 | | | $153,402 | | | $230,103 | | | $2,147 | | | 0% | | | | Actual Payout | | | | | | | | | | | | | | | 33.0% | |

For the 2019-2021 performance period, the below named executive officers received the payouts as set forth below in March of 2022 which represented 33.0% of the target amount.

| Rafael Santana

| | | 4,620 shares of Wabtec common stock with a value at payout of $431,531

| | | David DeNinno

| | | 2,431 shares of Wabtec common stock with a value at payout of $246,589

| | | Pascal Schweitzer

| | | 990 shares of Wabtec common stock with a value at payout of $92,470

| | | Patrick Dugan

| | | 3,241 shares of Wabtec common stock with a value at payout of $339,060

| |

Mr. Olin and Mr. Gebhardt did not participate in the plan as they were not Wabtec employees at the time these awards were granted.

For the 2020-2022 and 2021–2023 awards, the Compensation Committee made adjustments to the long-term incentive plan program performance metrics reflecting the significant changes to the Company with the completion of the GE Transportation transaction. Rather than utilizing the single metric of Economic Profit, the Compensation Committee established the use of three metrics: 1) three-year average annual Return on Invested Capital (“ROIC”);2023-2025.

| 38

| | |  l2024 Proxy Statement for 2022 Annual Meeting | / | | 53 |

TABLE OF CONTENTS Compensation Discussion and Analysis

|

2) three-year average annual Cumulative Cash Conversion (“CCC”);The performance unit awards for the 2023-2025 cycle, like the awards for the 2021-2023 and 3) Relative Total Stockholder Return (“RTSR”). 2022-2024, use three metrics:

ROIC and CCC results are each weighted at 50% respectively.. The combined results from the two goals are then subject to modification upward or downward (+/-10%) based on Wabtec’s RTSR results.results versus the defined Peer Group. For the 2023 – 2025 performance awards, the modifier was increased from +/-10% to +/-20%. For purposes of these awards: 1)

| ROIC means for a year (A) the Company’s Adjusted EBITDA after tax, divided by (B) the sum of the Company’s year-end net debt plus shareholders’ equity. For this purpose, Adjusted EBITDA means the Company’s income from operations plus other income plus depreciation and amortization, as adjusted for presentation to the Company’s investorsrestructuring costs and set forth in the Company’s annual earnings release. |

2)

| CCC means for a year (A) the Company’s cash from operations divided by (B) the sum of the Company’s net income plus depreciation and amortization.amortization, as adjusted for certain restructuring costs. |

3)

| RTSR measures the percentile ranking of the Company’s total stockholder return (changes((“TSR”) which means changes in stock price plus dividends) for the performance period against the total stockholder return of the Company’s compensation peer group described above.XLI Index for the 2023-2025 grant. The XLI Index mirrors the S&P 500 Industrials Index and is comprised of 72 companies, including Wabtec. The change was made to more accurately represent industry and investor peers. |

Beginning with the 2022 awards, ifIf Wabtec achieves the maximum three-year cumulative ROIC and CCC results, a participant can earn a maximum number (equalof performance units, equal to 200% of the target level) of performance units.level. The RTSR modifier cannot increase the payout above 200% of the target. If Wabtec achieves the threshold three-year ROIC and CCC cumulative goals, a participant can earn a threshold number (equalof performance units, equal to 25% of the target level) of performance unitslevel, which would be subject to modification up or down based on RTSR. Payouts wouldcalculated under the ROIC and CCC metrics range from 25% of target for actual performance at 75% of target to 200% of target for performance at or above 125% of target. No performance units would be earned for performance below the three-year cumulative ROIC and CCC and thresholds.

The long-term incentive program is intended to encourage the long-term stability of Wabtec’s management by establishing ambitious goals designed to promote the long-term productivity and profitability of the Company. If a program participant leaves the Company voluntarily, or is terminated for cause, they are not eligible to receive any performance units he or she may have earned under the program. If a program participant leaves the Company for death, disability, termination without cause, or retirement, their payout may be pro-rated in accordance with the amount of time they participated inawards continue to vest, subject to actual performance results for the program relative to thefull performance period. These goals were based on a range of considerations including expected demand in Wabtec’s key end userend-user markets, investor expectations and management’s business plan which includes year over year growth. Equity awards madeLong-Term Incentive Payouts (2021-2023 Performance Units)

Payouts under our 2021 — 2023 performance unit plan are summarized below. Actual Peer Group Total Stockholder Return over the three-year period ranged from 15.29% at the 25th Percentile to 39.10% at the 75th Percentile. The Company’s TSR of 69.10% over the same three-year period fell above the 75th Percentile resulting in a modification of +10.0%. Total Stockholder Return (“TSR”) | | | 15.29% | | | 17.07% | | | 25.66% | | | 26.91% | | | 34.31% | | | 39.10% | | | 69.10% |

Modifier | | | -10.0% | | | -7.5% | | | -5.0% | | | 0.0% | | | 5.0% | | | 7.5% | | | 10.0% | | | 10.0% |

54 | | / | 2024 Proxy Statement |

TABLE OF CONTENTS Compensation Discussion and Analysis

Actual ROIC and CCC performance for the 2021 to all named executive officers are detailed– 2023 performance period exceeded the target goals resulting in a payout under the table “2021 Grantsplan of Plan 132.0% of target. When applying the impact of the RTSR modifier at +10.0% (impact of +13.2%), a payout of 145.3% of target was earned under the plan. ROIC

(50% Weighting) | | | | | | 8.8 | | | 136% | | | 68.2% | CCC

(50% Weighting) | | | | | | 96.2 | | | 128% | | | 63.9% | Total Before Modifier | | | | | | 132.1% | Modifier (+10.0%) | | | | | | +13.2% | Total Payout | | | | | | 145.3% |

Based Awards” on page 44. Options and restricted stock are generally granted to employees, including our executive officers, each Februarythese results, for the 2021-2023 performance period, the NEOs received the payouts as partset forth below in March of their long-term compensation. 2024.Rafael Santana | | | 69,095 shares of Wabtec Common stock with a value at payout of $9,304,850 | David L. DeNinno | | | 11,755 shares of Wabtec Common stock with a value at payout of $1,583,016 | Pascal Schweitzer | | | 9,117 shares of Wabtec Common stock with a value at payout of $1,227,763 | Eric Gebhardt | | | 7,199 shares of Wabtec Common stock with a value at payout of $969,471 |